BTS 49-23

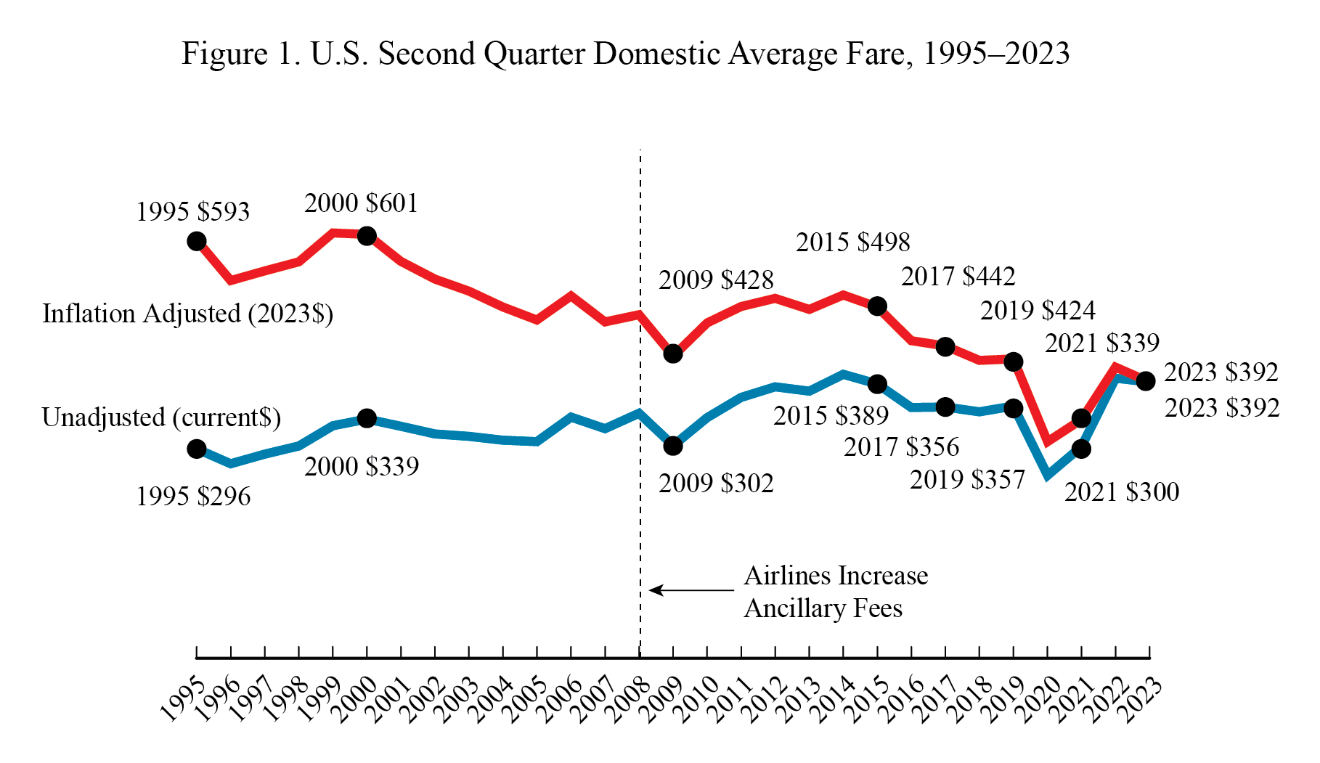

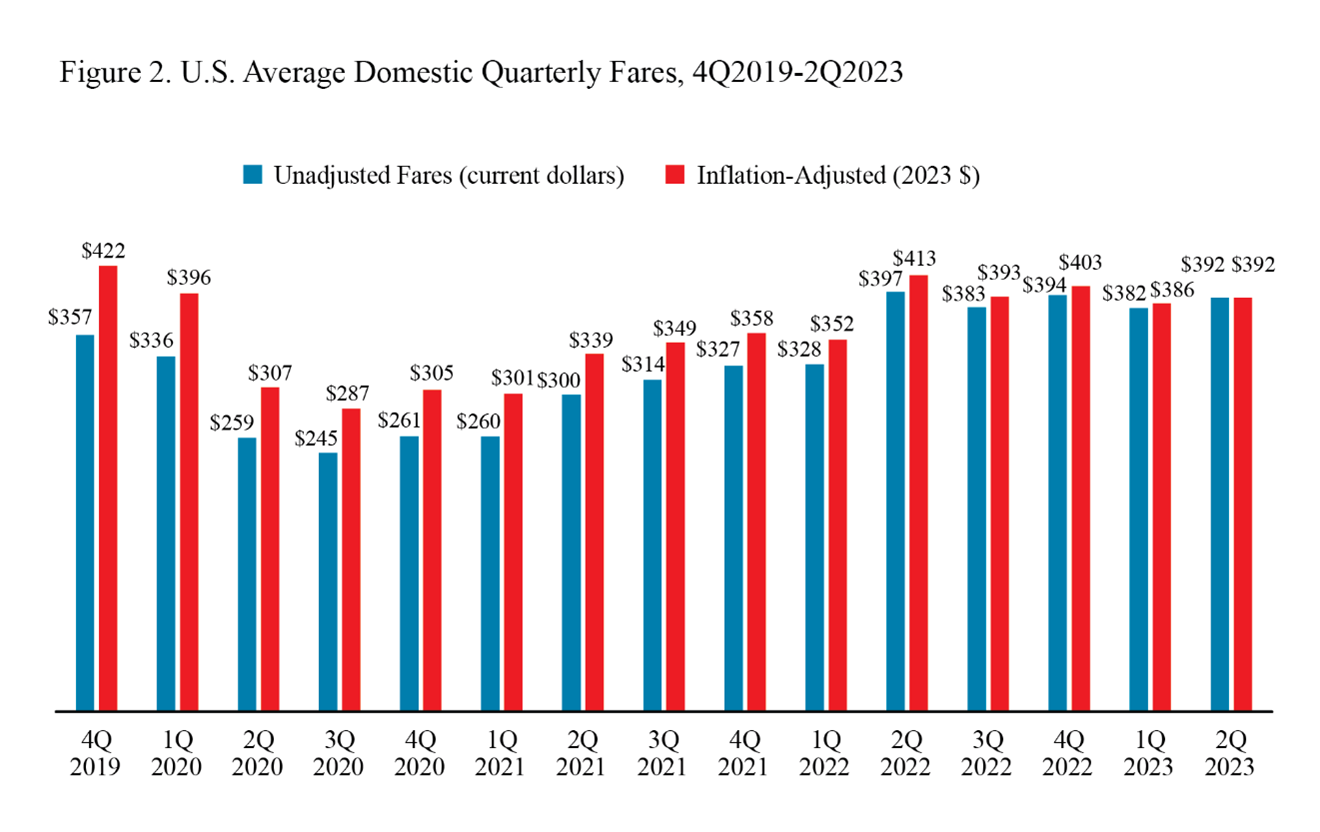

The common United States home air fare elevated within the second quarter of 2023 to $392, up 1.5% from the primary quarter 2023 inflation-adjusted fare of $386. Adjusted for inflation (fixed 2023 {dollars}), the typical second quarter 2023 air fare was up 27.7% from $307 within the first full quarter of the pandemic in 2020 and down 7.1% from fourth quarter 2019 (pre-pandemic) fare of $422.

Within the second quarter of 2023, passenger demand elevated with U.S. airways reporting 88.8 million originating passengers, up 87.1% from 11.5 million passengers within the second quarter of 2020.

Itinerary Fares: Spherical-trips and one-way tickets if no return is bought.

Breakout of journey sorts: one-way, 40% ($279); round-trip, 60% ($484).

Fare calculations by Bureau of Transportation Statistics (BTS)

*Based mostly on a pattern of roughly 10% of complete tickets offered.

Whole ticket worth: The value charged by airways at time of ticket buy.

Included: All charges and fees levied by an air provider required for the passenger to board the plane. Additionally, extra taxes and charges levied by an out of doors entity at time of ticket buy.

Not included: Charges for non-compulsory providers, corresponding to baggage charges, seat upgrades, and choosing an assigned seat on the plane.

Inflation-Adjusted Common Air Fares

Second Quarter 2023 fare ($392):

In comparison with all second quarters: Down 35.0% from the very best second quarter fare, $603 in 1999.

In comparison with all quarters: Down 36.1% from the very best fare for any quarter, $613 in first quarter 1999.

Begin of BTS data: Down 34.6% from first quarter 1995 ($599).

Current excessive: Down 9.7% from fourth quarter 2018 ($434).

Current low: Up 36.7% from third quarter 2020 ($287).

All-time low: Up 36.7% from the earlier low third quarter 2020 ($287).

All-time second quarter low: Up 27.7% from the earlier low second quarter 2020 ($307).

Different Income: In recent times, airways have more and more obtained extra income from passenger charges, in addition to from different sources. U.S. passenger airways collected 75.3% of complete working income of $87.2 billion from passenger fares in the course of the six months of 2023, down from 88.5% in 1990.

Unadjusted Common Air Fares

Second Quarter 2023 fare ($392):

Development: Up 2.7% from first quarter 2023 ($382).

In comparison with all second quarters: Down 2.6% from the very best second quarter fare, $402 in 2014.

In comparison with all quarters: Down 2.6% from the very best fare for any quarter, $402 in second quarter 2014.

Begin of BTS data: Up 32.0% from first quarter 1995 ($297) (in comparison with 101.6% shopper worth enhance).

Current low: Up 60.1% from third quarter 2020 ($245).

Current excessive: Down 1.4% from second quarter 2022 ($397).

All-time low: Up 60.1% from third quarter 2020 ($245).

All-time second-quarter low: Up 51.2% from second quarter 2020 ($259).

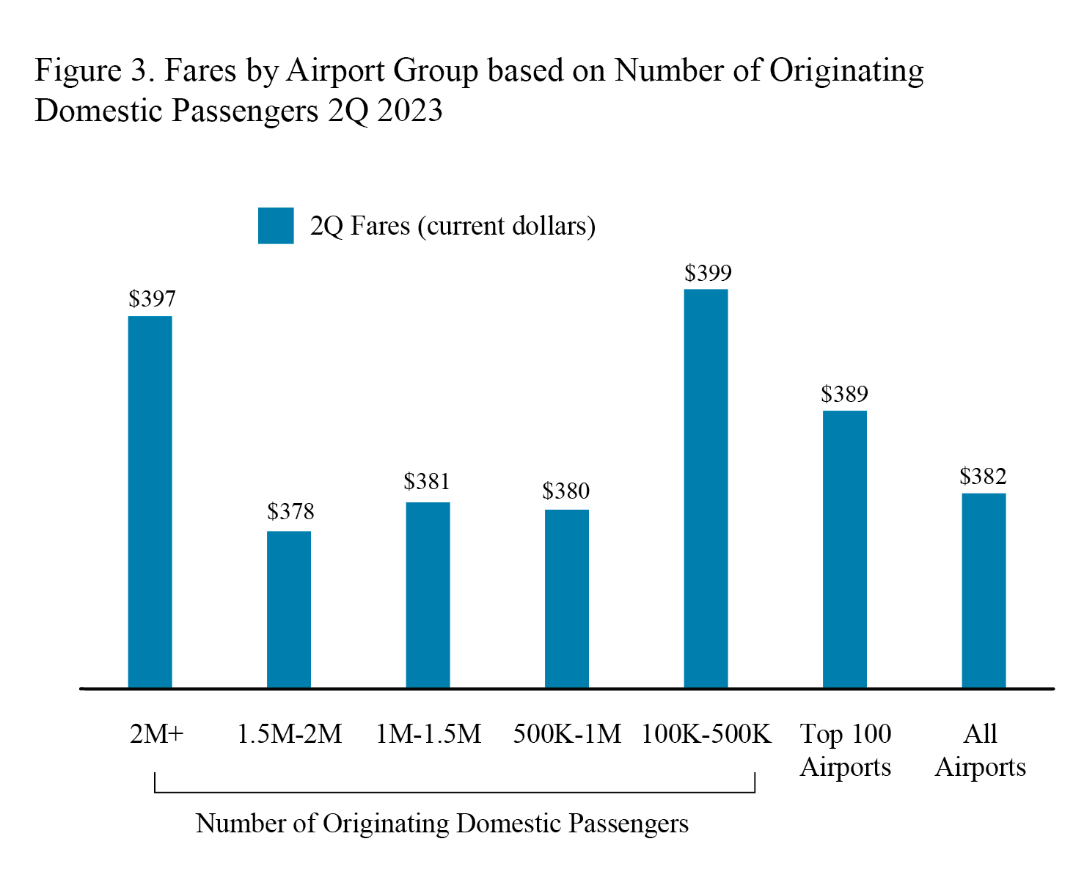

Fares by airport group:

Highest: 6 airports with 1.5-1.99M originating passengers ($378)

Lowest: 50 airports with 100,000-499,999K originating passengers ($399)

Further information: see High 100 Airports or All Airports. Third Quarter 2023 common fare information will probably be launched January 16, 2024.

Normal error: Outcomes for common fares are based mostly on the BTS Origin & Vacation spot Survey, a ten% pattern of airline tickets used in the course of the quarter. Averages for airports with smaller samples could also be much less dependable. For first quarter 2023 outcomes based mostly on all itinerary fares, the usual error is 0.30 and the median fare is $323.45. The 90% confidence interval ranges from $391.29 to $392.29. For outcomes based mostly on round-trip fares, the usual error is .38 and the median fare is $422.22. The 90% confidence interval ranges from $483.66 to $484.93. For outcomes based mostly on one-way fares, the usual error is .36 and the median fare is $228.31. The 90% confidence interval ranges from $278.10 to $279.28.