SAM Journal—Winter Park, Colo., Nov. 15, 2023—The increase in summer season lodging enterprise at Western mountain locations cooled this previous summer season, with revenues flat in comparison with the prior season, and winter enterprise seems to be following an analogous sample. That is the information in line with the newest month-to-month Market Briefing from DestiMetrics, the enterprise intelligence division of Inntopia. These tendencies are based mostly on ends in 17 mountain vacation spot communities throughout Colorado, Utah, California, Nevada, Wyoming, Montana, and Idaho.

The Might-October summer season season wrapped up with a 1.8 p.c lower in occupancy, and a 1.5 p.c improve in day by day charges in comparison with one 12 months in the past.

“These ultimate summer season numbers verify a ‘reset’ within the exploding charge progress now we have recorded prior to now couple of years,” mentioned Tom Foley, senior vice chairman of enterprise intelligence for Inntopia. “We could lastly now be seeing day by day charges which can be extra sustainable for the long run.”

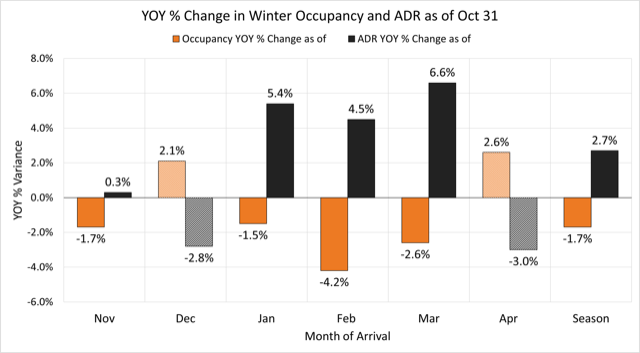

DestiMetrics’ winter tally picks up the place summer season left off. As of Oct. 31, on-the-books occupancy for the winter season, November by April, was down a slight 1.7 p.c in comparison with the identical time final 12 months. Every day charges for the complete winter are up 2.7 p.c, however down for the months of December and April.

Foley famous that prospects had been, and clearly stay, worth delicate. In months the place charges are down, reservations are up, and the place charges are up, reservations are down, “a continuation of charge patterns that we noticed being reset in the course of the summer season,” he mentioned. (See chart for particulars.) Nonetheless, the Briefing additionally notes that charges are up greater than 40 p.c because the pre-pandemic fall 2019.

The reserving tempo was down 7.1 p.c in October, the second decline prior to now three months, with November down 7 p.c, January 8.3 p.c, and February down 10.5 p.c. Foley famous, although, that reserving quantity was very robust final fall, making for robust comparisons. He added that charges had softened throughout October however remained barely forward of final 12 months’s document highs.

“The delicate reserving tempo for January and February is the first offender within the softening season occupancy, though an absence of bookings for late December/Christmas week arrivals additionally play a task,” Foley mentioned. Whereas the vacation week is more likely to refill as ordinary, “the first concern is that after that first week in January, there’s a decline in occupancy that’s carrying by the Martin Luther King weekend and effectively into February and the President’s Day weekend.”

The timing of the Christmas and Easter holidays will probably affect month-to-month outcomes this 12 months. December faculty breaks are comparatively late, with many Ok-12 college students not on break till Dec. 22; that later begin is pushing visits into the primary week of January—which is at the moment strongly over-performing final 12 months. An early Easter Sunday on March 30 can also be more likely to compress many bookings into late March, whereas doubtlessly making a deficit for April.

Value sensitivity is creating charge stability. There’s an inverse relationship between occupancy (orange bars) and room charges (black bars). The place year-over-year charges are up, occupancy is down, and vice-versa (grey and pale orange bars). Charge sensitivity is anticipated to proceed as journey competes for customers’ discretionary {dollars}.